This is an interview of Ms.Una Meistere, the director of Arterritory.com, with Adriano Picinati di Torcello, a director within the advisory and consulting department at Deloitte Luxembourg, about the trends in the art market, whether art objects can be considered as pure investments and what are the new existing solutions. The interview is originally published at Arterritory.com, http://arterritory.com/en/texts/interviews/7789-the_art_market_is_increasing_in_transparency/ *

*Intro by ArtLaw.club

Una Meistere

Director of arterritory.com

11/10/2018

An interview with Adriano Picinati di Torcello, a director within the advisory and consulting department at Deloitte Luxembourg

(the interview is originally published at Arterritory.com, http://arterritory.com/en/texts/interviews/7789-the_art_market_is_increasing_in_transparency/ )

‘What we are experiencing now in the art market over the last 15 or 20 years is something that has never happened before in art history. It is a little bit like a revolution. And we have a lot of factors affecting the art market at the same time. The first one, definitely, is globalisation and democratisation of the art market. If some time ago the art market was mainly focused on Europe and the USA, today it is definitely global – Africa, South America, Asia; the art market is everywhere now. Democratisation means that more and more people are interested in art. Just look at the number of people who are going to art fairs and buying art objects.

To illustrate the globalisation aspect – we had a financial crisis in the early nineties in the art market, and this was mainly driven by the Japanese crisis. When the market went down, it took nearly 14 years for it to come back to it's previous level. In 2008 we had another crisis, if you remember, and at that time it took less than 18 months for the art market to recover. This means that the art market can absorb shocks faster than previously mainly because of globalisation. Just look at China’s art market share: in 2005 it was 3.7%, but in 2016 it was already up to 19%. And if we look at different categories, for contemporary art it is perhaps the biggest market in the world. So, it is a completely new dynamic! […] We have estimated that ultra high-net-worth individuals have now invested around 1.6 trillion dollars in collectible assets, and by 2026 we estimate that this amount will be 2.7 trillion. More and more wealthy people are buying art objects, thereby creating a demand for art and wealth management services.’ This is how Adriano Picinati di Torcello, a director within the advisory and consulting department at Deloitte Luxembourg, described the current situation of the global art market in his presentation ‘Investment in art – what is driving the record-large interest in art investment?’ at the Swedbank Private Banking Seminar in Riga.

Having worked for many years as a business adviser in the financial industry, Adriano Picinati di Torcello is in charge of coordinating art and finance activities at Deloitte Luxembourg and in the Deloitte global network of Member Firms. He co-writes Deloitte and ArtTactic’s Art & Finance report, published every 18 months, which compiles information from finance consultants, art professionals, and art collectors regarding the main trends and developments in the global art market. Adriano also organises the annual Deloitte Art & Finance conferences, which since 2004 have been held in various cities around the world.

What are the main reasons why people buy art? What makes up the value of a work of art? Was the controversial sale of Da Vinci’s Salvator Mundi a wise investment? How could investing in art benefit society, cities, regions or countries? These are only a few of the questions that were covered in Arterritory.com’s interview with Adriano Picinati di Torcello.

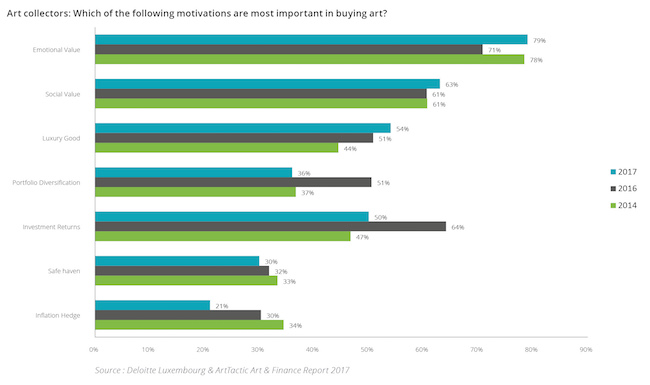

According to last year's Art Basel and UBS Global Art Market Report, on the list of motivations for why people buy art, financial investment was just number five – coming in after aesthetic, emotional and cultural motivations and such. There are still many people in the industry who are convinced that art should be bought and sold because it is enjoyed and generates a special response in the viewer. However, the Deloitte report states that ‘art collectors appear to be increasingly focused on investment returns’. How would you comment on this?

I tried to explain today that this pure investment part is extremely limited. It’s a bit misleading when we say that art is an investment. The majority of collectors buy (I don’t like the term ‘invest’) art for purely emotional reasons; that is the main driver. Nevertheless, for the majority of them, the financial component is there as well. What does that mean? For them, it’s not that it’s like an investment on which they’re looking for a return, but they do want to be informed. They don’t want to crazily throw money around – they want to know the value of the art, is the price fair for that specific work, and so on. The financial aspect is part of the equation. It is not a transaction that is done without financial consideration. Large sums are involved. So unless it’s a case of two people with dueling egos simply outpricing one another and flashing millions, the money factor must be taken into account. Art is something people buy once their other needs have been met, but still, it is not to be taken lightly, and people do not want to act foolishly.

The art market is increasing in transparency, data is available, and people are beginning to benchmark. When you go to an art fair, you may see similar paintings by the same artist, but with major differences in their prices; if you’re a new collector, you may wonder why that is. One needs qualitative analysis, but also quantitative analysis. Anyone who goes into a gallery or wishes to make a transaction needs both types of information: why this is a good artist, why this is a good artwork by this artist, and also some rationale about the price. That’s the financial component...over time, art can become a part of one’s financial assets. We all try to protect our total wealth, and this is part of that, so it should not be disregarded. It is just good financial management, if I may say so. Depending on the country you live in, it is likely that you will have to pay taxes on your art. So you should know the value, you should have documentation, and you have to take care of this asset. And if it’s an emotional asset, you will want to protect it even more.

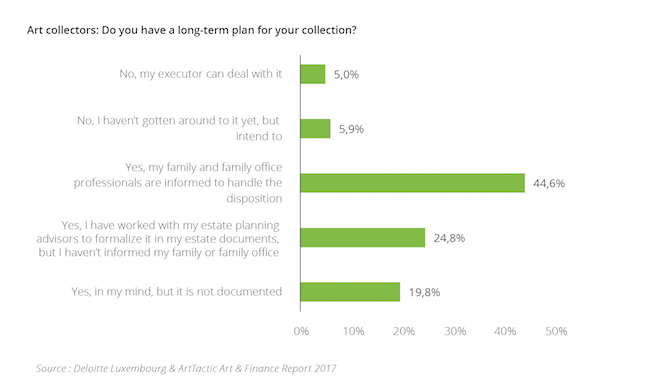

Image taken from Deloitte Art and Finance Report, 2017. Courtesy of Deloitte

To regard art as an asset is nothing new; I think it goes back to at least the 17th century. In your presentation, you mentioned the year 2004 as some kind of a turning point. Why was that year so crucial?

Art is an investment, but how do we define investment? Art acquisition has existed for hundreds of years. If we go back to the Medicis, I don’t think it was an investment for them. They wanted to be patrons – it was to support the city, for glory, for their egos, the social impact and so on. There was no idea or plan for reselling art at the time of the Medicis. The Fine Art Group was founded in 2001, just when the market began to pick up: we saw prices increasingly break records – 500, 1000, one million, one hundred million. The financial interest in art objects was increasing – the financial component of it – and on top of that, at that time an article titled “Beautiful Asset: Art as Investment” was published in The American Economic Review by two professors, [Jianping] Mei and [Michael] Moses, on the underperformance of masterpieces. This university paper was also covered by the Economist and other newspapers, and it shed some light on the financial component of art objects. There were different elements; on the one hand, the market was booming, there was more publicity on this fact, and more transparency in terms of data...Sotheby’s had seen this happen in the 1960s, so it wasn’t a completely new thing, and it was coming again. So now there were these academic papers talking about this performance, and it created an appeal. From 2000 to 2008, the market was just booming in terms of pure investment. I must make it clear that as Deloitte, we do not make any investment recommendations; we do not say that art is or is not a good investment. We just say that if you want to look at it as a pure investment, you have to do that very carefully. You have to do your homework before you rush into it.

I believe that almost 80% of all art bought in local markets and at local art fairs would be hard to sell for more than its purchase price. And it’s not easy to resell because you have to find an appropriate gallery or auction house, and galleries are not always happy to take something back for reselling. Fashions and tastes change, and most academic art professionals are not willing to talk about art in terms of investing. To buy art as an investment is quite tricky.

It is super tricky. That’s why when we talk about art and wealth management at Deloitte, we tend to focus on protecting wealth and transferring wealth, but less on investment. Some people are very successful in pure investment – they have inside information, they watch the markets, they know the trendsetters, etc. Now for someone without all the right connections, it is really challenging […] We are extremely cautious about art as an investment. Yes, there is a ‘shadow’ art investment market, but when we look purely at the official art investment market, it is extremely small.

Image taken from Deloitte Art and Finance Report, 2017. Courtesy of Deloitte

Despite all of the attempts to regulate it, the art market is still very opaque and unregulated; but now that there is a growing interest in art investment, and the fact that art is now considered an asset class, do you see ways in which the market could change?

Yes I do, because the increasing interest in art as an asset is definitely one of the main drivers. If you compare it with any other industries or business sectors, the art market was very small 20 years ago – a few billions, and in the hands of a happy few. In any industry, as you begin to develop and become more international, more global, more transactional, you need to become much more sophisticated, more transparent. Any sector that goes into different development phases has to adapt to size; the market itself has to adapt. Of course, more experienced collectors know what they are dealing with...they are used to the market, they know how to be advised, but there is a whole group of new collectors who are interested in the art market – it’s appealing, it’s cool, it’s trendy…

It’s a part of the lifestyle.

They have money, they can buy things. But no one wants to be a fool. If they have a bad experience, they will not come back. But if you can help these new buyers, build their trust, help them get into the market, and to spend more, in the end they will be supporting the market, the different stakeholders, and the artists. Which is why trust is important in order to get all of these new collectors on board – the new collectors coming from emerging countries and everywhere else. We live in a world that is pushing for more transparency in everything. And the art market was a bit opaque. This may have been OK a few years ago, but not now.

Almost all objects on this planet that are bought or sold can be identified with a serial number. Art objects do not have this.

Quoting the Israeli art collector whom I interviewed last year: ‘Art becomes the ultimate offshore – the work of art could be in one country, and the money could be in a different country; and in the meantime, the seller also lives in another country, and the buyer lives in still another country, and lastly, the work of art is to be stored in yet another country. So, above this offshore is only the moon.’

That is another interesting element – it is a transferable asset, a movable asset; you don’t have a currency attached to it. People like this aspect, especially when one feels unsecure in a certain place. It’s much easier to move a painting than a house. If you look at the market process today, anytime you complete a transaction, you have to do due diligence. Is this a rational approach? Wouldn’t it be easier if a new buyer could get all of the information automatically, such as the fact that the condition report was done five years ago, etc. … all of the documents, the provenance and so on, would be there. My view is that this will increase trust, and increase liquidity because it is currently assumed that we own art objects for ‘forever’.

What do you mean by ‘forever’?

Exactly – why forever? If you create a market that is much more liquid, people will also be much more comfortable buying. You buy real estate because you can resell it; you are not stuck with it forever. We live on a small planet where ‘stability’ is not exactly the key word of our times. We live in a state of perpetual movement. Look at how the new generation behaves. When we analyse their behaviours, we cannot say that they will buy art for ‘forever’. They want to rotate their collections based on their tastes, where they live...and if they can easily do this, why not? Everything that will help this market become more transparent, increase trust, become more professional, increase liquidity, etc., will be an overall benefit for the market.

Today, everyone is dealing with images; everyone is on Instagram, on social media. We are bombarded with images. Contemporary art is considered to be ‘mega-cool’, you have these collaborations in which brands combine art with objects...culture is everywhere...we just saw Jay-Z and Beyoncé at the Louvre, standing next to these masterpieces. This made me say ‘Wow’ – it showed the museum from a completely different angle and to a new crowd... musicians and masterpieces are a very interesting combination. You can experience things differently. When we talk about art, it’s about emotion, about experience – with 3D, with virtual reality, we’ll be able to offer to everyone a way to experience art completely differently than before. People are really interested in that. We should not forget that art is also our world heritage. If people can have a piece of it by having it on their walls, or by having a fractional investment because they cannot buy a Banksy or whatever, but if they buy a share in company XYZ, it is something fun to talk about and they can also say that they are involved in the management of it. I think that people will like it. On top of that, it’s a social investment, so this may be an avenue that philanthropists will take.

This world is changing...I may be an idealist, but we can go in both directions and improve transparency with regulations. When I say regulations, I don’t mean only government regulations, but also market regulations. When we talk about valuation, for instance, in the US there is an appraisers’ association, while in some other countries nothing close to that even exists. Some countries have associations of auction houses; some don’t. Some countries have gallery associations with guidelines, with a code of conduct; others don’t. I’m not saying that we need something on the same level as medical doctors do, in which there are very strict rules and regulations. But the more money involved, the more it will attract another kind of crowd. You can do your business as properly and correctly as you want. But if someone in your field is doing something wrong, this will affect you as well – like the saying about one bad apple spoiling the barrel. This market attracts a lot of visibility; every time a scandal occurs, news of it travels around the world and people become scared.

Image taken from Deloitte Art and Finance Report, 2017. Courtesy of Deloitte

If a market bubble develops, there’s the risk that quantity will increase but quality will decrease. There are many examples of this, such as the infamous Zombie Formalism; art is everywhere – it’s on social media, it’s fashionable, the prices are going up, but the market still lacks dignity…

That’s a broad question. Art is everywhere more than ever, and now the act of ‘creating’ can be done very quickly. We are far from being perfect, but there is more stability in the world, there is more wealth, which supports creativity to a certain extent...there are more people on this planet than ever before, and there are more wealthy people than ever before. Art is not only for the super rich; we have very affordable art fairs now, and we should be thankful for that, even for reproduction prints and such.

There are a growing number of people who have an interest in a cultural object. The demand is there, the offering is there, and with the help of technology, artists can increase their visibility and it is easier for potential buyers to search according to their tastes. Like in any sector, not everyone will be a ‘winner’, but if we support the sector correctly, there will be more ‘winners’ – people who are better off afterwards. I’m talking about all stakeholders: museums, the government, artists, collectors, secondary markets, the primary market. Culture is a very important element of our society. We have to give it its rightful place. Quite often I have the feeling that culture is not always being considered at the right level. Culture can fight against extreme thinking, it can help certain groups integrate into society, it opens our minds, it educates, it brings us joy, it helps one find a sense in life. These are the social factors, but there’s also an economic factor in terms of visitors, tourism and so on. But also, if you increase the quality of life and invest in your location, people will be better off. In case you haven’t noticed, where you have a good museum, the price of real estate is high.

I visited the Louvre branch in Abu Dhabi a few weeks after it opened, and there were long lines of people waiting to get in. But once I was inside, I noticed that most people were spending only a few seconds looking at each artwork. They are paying for museum tickets but once they’re in, they’re mostly interested in taking pictures and selfies and posting them on social media. When art has blown up into such a trend-bubble, is society, in general, gaining any intellectual value from it?

Yes, I have observed the same thing, but I must contradict you a little bit in that the reality is that the Louvre Abu Dhabi is so huge that if you spent several minutes on each artwork and read all of the accompanying texts, you would have to spend several days there. It is virtually impossible. What is interesting is that even if you spend just a few seconds on each work, you educate your eyes; your brain is good at collecting and managing a lot of data. Art is also about emotion; you may look at ten thousand things and not react, and then at one point, there’s one where you say: Oh...my...God. I am sure you have experienced this kind of moment in front of an art object. So, these people are getting something out of it – they get at least some familiarity with the collections, they see the splendid architecture of the institution itself.With the Louvre Abu Dhabi collection, you have this mega cultural infrastructure that spans centuries and that mixes three civilisations: Asia, the Middle East and the Western world. It is enlightening, especially in a region where there are known tensions. It shows the importance of culture to a country because it is not just a purely cultural initiative but also a sort of soft-power tool. It affects the brand of the UAE positively by putting several plus signs next to it; people want to go there for more than just the beaches now, and if they continue with the Guggenheim and so on, this small piece of land could potentially become a true cultural destination.

Do you think it was wise for them to pay 450 million for da Vinci’s Salvator Mundi?

450 million is a lot, but if you look at the numbers, how many people are going to come to the UAE just to see this painting? If you look at any museum, they all have some iconic works – they usually provide visitors with a small catalogue of ten must-see objects. In terms of people spending just a few seconds on each work, they will at least go see the works listed in the catalogue, and these will become the brand of an institution. I think that for the Louvre Abu Dhabi, this kind of a painting will definitely attract a lot of people.

If you look at purely the financial aspects, i.e. without taking into account the ripple effects, how much is a painting like that worth – maybe 100 million? I don’t know. But if you look at the commercial impact, the marketing impact of a global campaign – this could help attract an additional one or two million visitors a year, and then add to that the additional revenues for planes, restaurants, hotels and so on. How much does it cost to elevate your level of soft-power? If you combine all of these elements, is it cheap? Is it expensive?

What I find interesting is the way it opens up a new dimension of how we look at culture. An iconic art object can create many other benefits. How do you value them? That is the amount that you are willing to pay for it. Could this inflate the prices of other iconic works? Maybe. The price has to include all of these different elements and the total impact that it is going to create. How much would it cost to achieve the same without this iconic work? Look at any marketing campaign – they all evaluate the returns in terms of images, press coverage, whatever. And I think that culture is also a part of that. Look at the dimension that the country or region or city level that we have to consider. It is important to understand that culture is not just about educating the masses. It should impact society locally but also internationally. This is why it needs to be created well and managed well. [...] Sometimes I wonder why certain countries who have this kind of a world heritage don’t try to manage it in a more active and dynamic way to leverage it in the best possible way. They just surf on the wave of having it and assume that people will come. We need to move away from the role of pure conservator to that of a more active manager of cultural assets. You can get much more benefit for your country and for your people. The more people you have coming in, spending more time there, the more jobs you can create. A difficulty is that we often tend to be very short-term oriented, but culture has long-term benefits that take time to be generated. A museum is not just about restaurants, ticketing and shops. It is much more than that; it needs to be properly managed and people need to understand that. My recommendation to museum directors is to speak that language, to get across the value that they are creating – not just economic value, but also social value. We have tools to do that. And that will also help them attract financial investors because if you’re an investor, you may want to give a gift, but you want to be sure that the money you give is going to be well spent. An investor may have ten options in front of them, and that is why cultural institutions must develop these types of elements that explain how the money is going to be spent, what is the impact that is going to be created, and how this is going to be measured. This will make it easier for investors to select what to invest in among the many choices out there.

Cultural investment is at a crossroads where there is a kind of ‘competition’ going on between private and public museums [...] but there is also a middle ground – a public and private partnership. There is also competition among countries and cities, for instance, in Spain there’s Barcelona, Bilbao, Malaga...look how many new museums have been built in Malaga in recent years – five or six at least, and they’re good cultural offerings. We talk about the ‘Guggenheim effect’ in Bilbao, but when you look at the visitor numbers in Bilbao compared to Malaga, they are approximately the same, and this is thanks to culture. Cities, countries and regions have to pay attention to this because there is ‘competition’ (not an aggressive kind) going on between them involving real estate, airlines, hotels, shops, etc. – we have to look at the big picture.

Image taken from Deloitte Art and Finance Report, 2017. Courtesy of Deloitte

The responsibility of the collector also has quite an impact, especially on the market; in some countries, collectors are more powerful than museum directors in this sense.

This is a very good point. If a collector wants to burn their entire collection, they are free to do that. There is nothing forcing a collector to be socially responsible.

What is surprising is that many collectors don’t have a plan regarding what is going to happen to their collection when they die. Statistically, they tend to pass it on to the family; some have their own foundations. In the past, many private collections were eventually given to institutions, but not anymore. Museums may not have enough walls to ensure that the works will be permanently on view…

It costs a lot to keep and show works…

And for many other reasons. If a collector wishes to be socially responsible, it’s up to them.

This recent growth in interest in art has also led to other tangential businesses, such as storage facilities – studies show that 80% of all art that has been bought is in storage; which means it is not being seen by anyone. There are also cases when art is bought without being seen in person, just through JPG images, and once bought, it goes directly into storage.

Yes, today we absolutely need storage. There aren’t enough walls, and the quantity of art is constantly increasing. It is simply the fact of the matter. And it needs to be stored in good conditions; we need quality storage facilities. It is not always the case that the fact that something is in storage is the reason that it can’t be exhibited. Most collectors, public or private, look at their collections. It is a misconception that they don’t. The number of people who buy art purely for investment purposes and keep it in storage continually is very limited. Storage is needed, and just because something is in storage does not mean that it is not going to be exhibited.

Thanks to technology, all of these artworks that are in storage can now be made accessible. Everything can be digitalised and offered online. This is fantastic – we have this mega library of objects. Today’s technology allows for such high-resolution images and screens that through digital methods, we can see the art even better than with the naked eye. And with a click of a button, you can sit in your home and go from antiquity to modern...it’s a completely new way in which you can enjoy your art.

Six to eight percent of all art market transactions take place online now, and that number will increase. It used to be that if you were in the USA, and wished to buy a piece of art that is in Europe, you had to deal with sending photos and letters through the mail. Now you can do everything from your home: share images, look at the piece from all angles, zoom in and zoom out, even see what it will look like on your wall. Of course, if it is a very expensive object, you will either go see it yourself or send someone to do that for you. With any transaction that takes place online, you have two weeks in which you can reverse it. It’s like with shoes – why would someone buy shoes online if they didn’t have the possibility to send them back if they don’t fit? If you put the artwork up on your wall and you don’t like it, send it back. It’s a new way in which we interact with the art market. It is also now possible to lease art objects. You can have them on your walls for one or two months, and if there’s one you like in particular, you can buy it.

It almost sounds as if art has become just another commodity, like shoes.

Not really. What they now have in common is the flexibility in acquiring them. […] It’s another way in which one can engage in the art market. If we can make it easier for people to approach art, then that is a good thing. If you want to put up a poster of an artist’s work on your wall, technology will also make things like copyright issues easier to handle, and the artist will receive proper compensation; parallels can be drawn to the online music industry.

It is not always easy for an artist to make a living – we should not forget that that is their job. Being an artist is a professional job, and it should be managed in that way. I am not saying that being an artist is the same thing as being a plumber, but they still do need the same things – a place to live, a way to support themselves and a family. In the end, an artist must sell their art objects – it is important to the artist and to the galleries; they are traders who must sell. Artist should have managers just like musicians do – an intermediary for the artist who can do all the administrative work and ensure that the artist gets the highest returns possible.

Image taken from Deloitte Art and Finance Report, 2017. Courtesy of Deloitte

When speaking with art historians, critics or art theorists, the subject of money is always a tricky one to approach. It is not considered good taste to bring it up.

Absolutely, I understand. ‘We should not mix art with money’ is something that we hear a lot. Although there are some regions that have no issue at all to discuss the two together. When we talk about investment, that’s something different. For an artist, for a gallery, it’s important to talk about the primary market and the secondary market. Do people think that auction houses don’t talk about money? Money is involved. It will always be like that. It is normal that a painting that has importance in art history will increase in value over time. This benefits the entire value chain as well. Artists hope that their work will increase in value over time, as do galleries and auction houses. Are they then automatically investors, speculators? Let’s be realistic and honest – money is involved, and it is in the interest of every one of those players to have prices increase.

Do you think there is a red line in terms of the price of a single piece of art, one that will not be crossed?

I don’t have a crystal ball; I cannot say. Look at other sectors, such as real estate. I live in Luxembourg, where prices are really high. People keep saying they can’t go up much more, they just can’t. But they do. It’s a question of rarity. When you have something that is very rare, and the number of people interested in it continues to rise, it becomes iconic. Its value becomes the price that you are willing to pay for it. If someone wants to pay one billion for this Leonardo tomorrow, no one can prevent that from happening. No one thought that it would go as high as 450 million [which includes a 50 million buyer’s premium – ed.]. Do you know how the last seconds of the auction played out? The last jump was very large [from 370 to 400 million – ed.]; the buyer was very sure that they wanted it and they were willing to make a huge jump to make sure that they got it. This was a very exceptional case, of course. I doubt that another painting will fetch this much in the near future; indeed, very far from it. One must be very very rich – it’s not just individual people here, it’s institutions, countries – and there’s much more at play here than just decorating the walls. The dimensions here vastly increase in number with all of the elements involved – with the cultural value, the number of visitors coming, the soft-power aspect – the ultimate value can all be explained.

In your presentation, you mentioned the case of the Picasso painting Buste de mousquetaire (1968), which in April 2018 was bought at auction by 25,000 people as a group from the Swiss online crowd-funding site QoQa. You said that art transactions of this nature will increase. Why is that?

In crowd funding, traditionally the community pools and gives their money for a cultural gain, but they don’t own anything. In this case, everyone who put up money now owns something. What is interesting is that it really works – they did it. And it was not a company that was in the art business. Would you invest 51 dollars to be able to say that you own a share of a Picasso painting?

Image taken from Deloitte Art and Finance Report, 2017. Courtesy of Deloitte

It seems like a thing to do for the sake of a funny experience (chuckles).

Yes, it is funny. It’s engaging, you’re part of a crowd, it’s fun. When you go to any museum, you pay for a ticket and in that way you are subsidising the art. One of the big issues in investing in art is how to evaluate the risk involved. This is a new phenomenon. Investment in art is not a new topic; it may have been limited, but it has existed for a very long time. But now, thanks to technology, it is something that a large number of people can participate in. Based on my intuition, but also on certain numbers from finance, I believe there is an interest to have financial exposure of art objects. There is a demand for that. No one has been able to make this happen, however. But now with blockchain, and the ability to trace financial transactions with blockchain, it is possible to match information with a physical object.

There are a certain number of initiatives that are moving in this direction. Let’s start with digital art objects. One of the big issues is that it can be easily disseminated to everybody; there is no scarcity with a digital art object. But with blockchain, we can now say that the original code is this one, and this is the entity that owns it. Now we can easily organise a market around digital art objects. The question is how do you create liquidity around it; that is one of the issues that remains to be solved.

What is interesting is that what is happening now is not something that I’ve seen before. I’m not saying that I’ve seen everything, far from it. But these initiatives around blockchain and fractional investment offer the possibility for larger numbers of people to access the art market. Seeing the number of people who are working on this, it is going to happen. I don’t know when it’s going to really take off – in two years or three years – but it will happen. I don’t see how it cannot happen. The technology is there, the demand is there. There are other issues to solve, even regulation – and thanks to blockchain, that’s cumbersome.

People can have various motivations to do this. It can be about investment, to be part of a partnership in which you are a co-owner, but you can also do it without a thought of ever selling or monetising it – you are doing it to be part of a social investment. That is an interesting dynamic. Will there be cases in which the government owns 51% of the shares [of an art institution] so that nothing drastic takes place, but the remaining shares are owned by the public, just so that the government can use its money for other social needs such as doctors, schools and so on? Is something like this conceivable? It is an open question, and an interesting debate. Some people may be against it, but will the majority be against it? It is a way that the public can be involved in cultural management.

Financial resources are necessary for cultural management. Take the case of the Rio museum – 90% of it is gone. Artifacts that were thousands of years old – impossible to find again, and now gone forever. It was a case of lack of funds for proper management, apparently. So the first task is to maintain, and then to develop.

Could we have a model in which the ownership of a collection/museum is shared and there is a marketplace where shares can be sold and bought, and shareholders have access to the museum? This would then cover the funds necessary to maintain and secure the museum. Is this a silly idea? Could citizens, could the Minister of Culture, accept such a model? These are new territories. I’m not saying it should be like that, but I am opening dialogue to the possibility. I think this could be another way to manage culture and to protect cultural heritage.

Time will tell.

We have to open our minds to alternatives and be creative. […] Remember when the Louvre rented/franchised its name to the museum in Abu Dhabi? There were heated discussions in France about what we should do with these funds: they sold the name, but they are now sitting on a 500-million-dollar endowment fund, and with this they can support the running of the museum. Another example is the Van Gogh Museum and the professional services that they offer. They have knowledge and experience on how to restore, how to transport, how to put on an exhibition. Running the museum itself is, of course, every museum’s first objective, but would other museums consider monetising this knowledge, like the Van Gogh Museum has? They could offer their services to wealthy collectors who don’t know how to organise an exhibition, how to execute it, etc. This way, the collector gets high-quality professionals to do it for them; the services are paid for, of course, and the collector will get to interact with the institution and, afterwards, may even become a patron of this institution. Why should other public institutions not consider such a model as well? Perhaps public institutions could open up their services to private corporate institutions that have big collections. The public cultural sector is suffering from a lack of funding, and we need to find alternatives. We need to come up with new solutions.

Comments: 20

Luckily, a friend introduced me to Capital Care Finance, a New York based company that offers loans regardless of credit score. I was approved for $150,000 at an 8% interest rate over 5 years, which helped me revamp my business. If you're in need of financial assistance, I recommend reaching out to them at their email: [email protected]

Luckily, a friend introduced me to Capital Care Finance, a New York based company that offers loans regardless of credit score. I was approved for $150,000 at an 8% interest rate over 5 years, which helped me revamp my business. If you're in need of financial assistance, I recommend reaching out to them at their email: [email protected]

Luckily, a friend introduced me to Capital Care Finance, a New York based company that offers loans regardless of credit score. I was approved for $150,000 at an 8% interest rate over 5 years, which helped me revamp my business. If you're in need of financial assistance, I recommend reaching out to them at their email: [email protected]

Are you in need of financial assistance? Look no further!

We offer quick and easy loan options to help you achieve your goals.

Loan Details:

Loan Amount: up to $100M

Interest Rate: as low as 5%

Repayment Period: up to 30 years

Flexible repayment options available

Why Choose Us?

Fast and easy application process

Competitive interest rates

Flexible repayment terms

Excellent customer service

Eligibility Criteria: Age 18+

How to Apply:

Email: [email protected]

Don't wait! Apply now and get the funds you need!

Are you in need of financial assistance? Look no further!

We offer quick and easy loan options to help you achieve your goals.

Loan Details:

Loan Amount: up to $100M

Interest Rate: as low as 5%

Repayment Period: up to 30 years

Flexible repayment options available

Why Choose Us?

Fast and easy application process

Competitive interest rates

Flexible repayment terms

Excellent customer service

Eligibility Criteria: Age 18+

How to Apply:

Email: [email protected]

Don't wait! Apply now and get the funds you need!

Your Trusted Loan Partner Head quartered in Washington Dc, USA

Are you in need of financial assistance? Look no further! We offer a range of loan options to suit your needs:

- House Loan: Achieve your dream of homeownership

- Car Loan: Get behind the wheel of your new vehicle

- Capital Loan: Boost your business with our flexible capital loans

- Business Loan: Take your business to the next level

- Personal Loan: Cover unexpected expenses or consolidate debt

Flexible Repayment Terms

Repay your loan over 1-30 years, with competitive interest rates. Our loan options are available to individuals worldwide, including those with bad credit.

Contact us today to learn more and apply for your loan! [email protected]

We are ready to finance your project. We offer flexible financial packages for various projects by passing the usual and formal procedures. We are willing to provide financing for up to 50 Million USD and above depending on the nature of your business. We would like you to provide us with a comprehensive business plan for our team of investment experts for review. We Take 5% interest rates up to a 20 years repayment plan.

Email: [email protected]

We are ready to finance your project. We offer flexible financial packages for various projects by passing the usual and formal procedures. We are willing to provide financing for up to 50 Million USD and above depending on the nature of your business. We would like you to provide us with a comprehensive business plan for our team of investment experts for review. We Take 5% interest rates up to a 20 years repayment plan.

Email: [email protected]

We are ready to finance your project. We offer flexible financial packages for various projects by passing the usual and formal procedures. We are willing to provide financing for up to 50 Million USD and above depending on the nature of your business. We would like you to provide us with a comprehensive business plan for our team of investment experts for review. We Take 5% interest rates up to a 20 years repayment plan.

Email: [email protected]

We are ready to finance your project. We offer flexible financial packages for various projects by passing the usual and formal procedures. We are willing to provide financing for up to 50 Million USD and above depending on the nature of your business. We would like you to provide us with a comprehensive business plan for our team of investment experts for review. We Take 5% interest rates up to a 20 years repayment plan.

Email: [email protected]

We are ready to finance your project. We offer flexible financial packages for various projects by passing the usual and formal procedures. We are willing to provide financing for up to 50 Million USD and above depending on the nature of your business. We would like you to provide us with a comprehensive business plan for our team of investment experts for review. We Take 5% interest rates up to a 20 years repayment plan.

Email: [email protected]

Generally, every customer wants a product or service that solves their problem, worth their money, and is delivered with amazing customer service.

Do you need financial assistance in your business?

Email [email protected]

Generally, every customer wants a product or service that solves their problem, worth their money, and is delivered with amazing customer service.

Do you need financial assistance in your business?

Email [email protected]

Generally, every customer wants a product or service that solves their problem, worth their money, and is delivered with amazing customer service.

Do you need financial assistance in your business?

Email [email protected]

Your Trusted Loan Partner Head quartered in Washington Dc, USA

Are you in need of financial assistance? Look no further! We offer a range of loan options to suit your needs:

- House Loan: Achieve your dream of homeownership

- Car Loan: Get behind the wheel of your new vehicle

- Capital Loan: Boost your business with our flexible capital loans

- Business Loan: Take your business to the next level

- Personal Loan: Cover unexpected expenses or consolidate debt

Flexible Repayment Terms

Repay your loan over 1-30 years, with competitive interest rates. Our loan options are available to individuals worldwide, including those with bad credit.

Contact us today to learn more and apply for your loan! [email protected]

Your Trusted Loan Partner Head quartered in Washington Dc, USA

Are you in need of financial assistance? Look no further! We offer a range of loan options to suit your needs:

- House Loan: Achieve your dream of homeownership

- Car Loan: Get behind the wheel of your new vehicle

- Capital Loan: Boost your business with our flexible capital loans

- Business Loan: Take your business to the next level

- Personal Loan: Cover unexpected expenses or consolidate debt

Flexible Repayment Terms

Repay your loan over 1-30 years, with competitive interest rates. Our loan options are available to individuals worldwide, including those with bad credit.

Contact us today to learn more and apply for your loan! [email protected]

anywhere in the world you want to be rich, famous, and posses power.

email : [email protected] for more

How to Join the Illuminati brotherhood!!! contact Lord Mike Fisher

anywhere in the world you want to be rich, famous, and posses power.

email : [email protected] for more

I am so happy about this because i got mine ATM blank card last week and I have used it to

get $55,000 Jetwebhackers is giving

out the card just to help the poor and needy though it is illegal but it

is something nice and he is not like other scam pretending

to have the blank ATM cards. And no one gets caught when

using the card. get yours from Jetwebhackers today! for more information on card

CONTACT:(Jetwebhackers @gmail .com)

TELEGRAM :@Jetwebhackers

WhatsApp: +1 (704) 252‑2290

You can also contact them for the service below

* Western Union Transfer

* Blank atm card

* Bank Transfer

* PayPal / Skrill Transfer

* Crypto Mining

* CashApp Transfer

* Bitcoin Loans

* Recover Stolen/Missing Crypto/Funds/Assets,..

I am so happy about this because i got mine ATM blank card last week and I have used it to

get $55,000 Jetwebhackers is giving

out the card just to help the poor and needy though it is illegal but it

is something nice and he is not like other scam pretending

to have the blank ATM cards. And no one gets caught when

using the card. get yours from Jetwebhackers today! for more information on card

CONTACT:(Jetwebhackers @gmail .com)

TELEGRAM :@Jetwebhackers

WhatsApp: +1 (704) 252‑2290

You can also contact them for the service below

* Western Union Transfer

* Blank atm card

* Bank Transfer

* PayPal / Skrill Transfer

* Crypto Mining

* CashApp Transfer

* Bitcoin Loans

* Recover Stolen/Missing Crypto/Funds/Assets